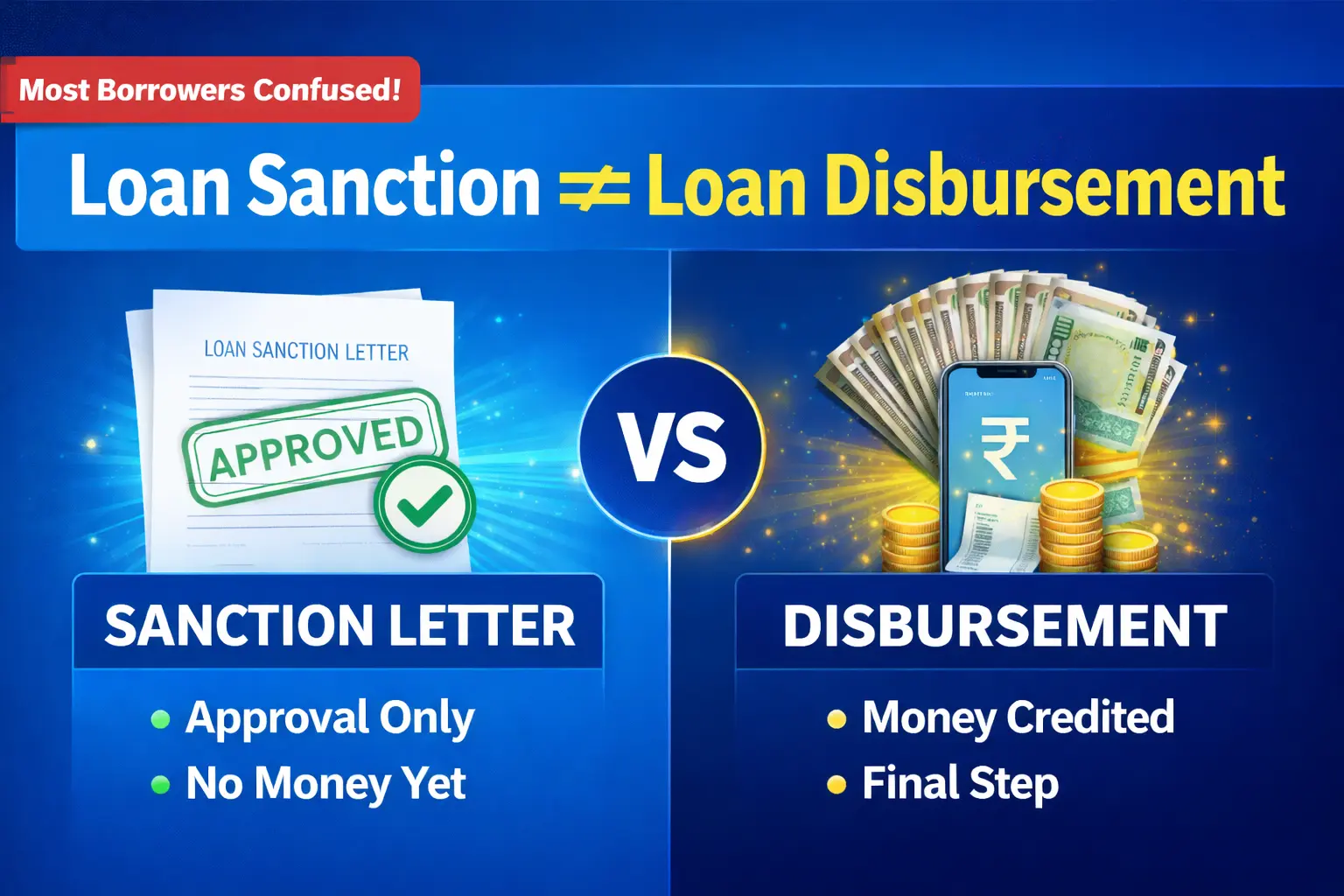

Many borrowers assume that once they receive a Loan Sanction Letter, the loan amount will be credited immediately. This is one of the most common and costly misunderstandings in home loans, mortgage loans, and business loans. In reality, loan sanction and loan disbursement are two entirely different stages of the lending process.

Understanding this distinction is critical to avoid property deal delays, builder penalties, or even last-minute loan cancellation. According to RBI’s housing loan guidelines, proper understanding of the sanction-to-disbursement journey is essential for every borrower.

What Is a Loan Sanction Letter?

A Loan Sanction Letter is a formal document issued by a bank or NBFC confirming that your loan application has been approved in principle based on your income, credit profile, and preliminary property details.

It acts as a financial “green light” — but it is not the final loan agreement and does not guarantee immediate fund release. For home loan applicants, understanding what a sanction letter means can prevent costly mistakes during property purchases.

Key Details Mentioned in a Loan Sanction Letter

| Component | What It Means for You |

|---|---|

| Approved Loan Amount | The final eligible amount, which may be lower than applied |

| Interest Rate | Fixed or floating rate applicable at sanction stage |

| Loan Tenure | Total repayment period |

| EMI Amount | Monthly outflow based on sanctioned terms |

| Terms & Conditions | Fees, penalties, and special clauses |

| Validity Period | Usually 60–90 days from issue date |

Borrowers must read the conditions carefully—failure to comply can delay or cancel disbursement. Use a reliable EMI Calculator to verify the EMI mentioned in your sanction letter.

Why a Loan Sanction Letter Is Important

1. Proof of Loan Approval

It confirms that the lender is willing to finance you, subject to compliance with conditions. For first-time homebuyers, this document provides confidence to proceed with property negotiations.

2. Financial Planning Tool

It allows accurate EMI budgeting and affordability assessment. Understanding how to calculate EMI for mortgage loans helps you plan your monthly finances better.

3. Negotiation Advantage

You can use sanction letters from multiple lenders to negotiate better interest rates or processing fees. Compare offers from leading banks using guides like SBI Home Loan vs HDFC Home Loan.

4. Builder or Seller Confidence

For home loans, a sanction letter reassures sellers and builders that financing is in place. This is particularly important for under-construction property purchases.

What Is Loan Disbursement?

Loan Disbursement is the stage where the lender actually releases funds—either directly to the seller, builder, or borrower—after all sanction conditions and legal checks are completed.

Disbursement is governed by documentation, property verification, and compliance with lender-specific requirements. According to RBI guidelines for home loans, proper verification is mandatory before final disbursement.

Loan Disbursement Meaning in Banking

In banking terms, disbursement refers to the actual transfer of the sanctioned loan amount. This may happen:

- In a single tranche (resale property)

- In multiple stages (under-construction property)

Only the disbursed amount attracts EMI interest. This is a critical distinction that many borrowers overlook when planning their loan against property or home loan applications.

Time Between Loan Sanction and Disbursement

| Loan Type | Typical Timeline |

|---|---|

| Ready Property Home Loan | 7–15 days |

| Under-Construction Home Loan | Linked to construction stages |

| Loan Against Property | 10–20 days |

| Business Loan | 3–7 days |

Delays usually occur due to documentation gaps, legal issues, or unmet sanction conditions. Working with experienced loan consultants in Kolkata or your city can help expedite the process.

Home Loan Disbursement After Registration: How It Works

For resale properties:

- Sale agreement executed

- Property registration completed

- Registration documents submitted to bank

- Final disbursement released to seller

Banks do not disburse before registration, except in rare builder-approved cases. This is in line with RBI’s Master Directions on housing finance.

Common Conditions Precedent to Loan Disbursement

- Submission of original property documents

- Signed loan agreement

- Property legal & technical clearance

- Down payment proof

- Insurance (if mandated)

Non-compliance with any condition can stall disbursement even after sanction. For loan against property applicants, ensuring clear property titles is especially critical.

Can a Loan Be Cancelled After Sanction?

Yes. A loan can be cancelled post-sanction if:

- Credit score drops

- Employment or income changes

- Property issues arise

- Sanction validity expires

This is why sanction should never be treated as final approval. Maintaining good financial discipline and understanding eligibility criteria throughout the process is essential.

Loan Sanction Letter vs Disbursement: Quick Comparison

| Parameter | Sanction Letter | Loan Disbursement |

|---|---|---|

| Nature | In-principle approval | Actual fund release |

| Legal Binding | Conditional | Contractually binding |

| Money Transfer | No | Yes |

| Risk of Cancellation | Yes | No (post-disbursement) |

Understanding these differences can save you from financial setbacks. HDFC Bank’s home loan guide provides additional clarity on documentation requirements.

Strategic Advice for Borrowers

Never sign a property agreement or commit payment timelines solely based on a sanction letter. Always account for:

- Disbursement timelines

- Registration and legal checks

- Sanction validity expiry

Professional loan coordination through trusted agencies can prevent costly last-minute surprises. Whether you’re in Kolkata or anywhere else in India, expert guidance matters.

FAQs: Loan Sanction & Disbursement

Is a loan sanction letter legally binding?

No. It is a conditional approval, not a final contract. Understanding the difference between home loan and loan against property helps clarify this further.

What is the validity of a loan sanction letter?

Typically 60–90 days, depending on the lender. According to SBI’s home loan policies, validity periods may vary.

Can EMI start before full disbursement?

Yes. EMIs apply only on the disbursed amount, not the sanctioned amount. This is especially relevant for under-construction property loans.

Can banks change terms after sanction?

Yes, if market rates or borrower risk profile changes before disbursement. Recent RBI guidelines have brought more transparency to such changes.

What happens if disbursement is delayed?

Property deals may get delayed and sanction may expire if conditions are not met in time. Working with experienced loan DSA partners can help avoid such delays.

Conclusion

If your loan is sanctioned but disbursement is delayed—or you are planning a Home Loan or Loan Against Property—expert handling can ensure smooth documentation, timely registration, and faster fund release.

Speak to a loan specialist at CreditCares to manage sanction-to-disbursement coordination efficiently.

Suggestions

- Home Loan Process Explained Step by Step

- Stages of the Loan Process

- Home Loan Registration Charges Explained

- Loan Rejection After Sanction Letter

- Understanding Joint Home Loans

- Loan Against Property Options in Kolkata

- Business Loan Eligibility Guide

- Government Loan Schemes for SMEs

- Home Loan EMI Calculator

- CreditCares Loan Services

Disclaimer: Loan terms, interest rates, and processing timelines are subject to change as per lender policies and RBI regulations. Always verify current rates and terms before applying.

Need expert assistance with your home loan or loan against property application? Contact CreditCares today for personalized guidance and the best rates from 50+ lenders across India.