Explore our expert

Improve Your CIBIL Score with CreditCares

At CreditCares, we understand how crucial a good CIBIL score is for securing loans and financial products at favorable terms. If your credit score is less than ideal, our comprehensive CIBIL Score Repair Service can help you enhance it, making it easier to achieve your financial goals.

What is CIBIL?

The Foundation of Your Credit Health

CIBIL, which stands for Credit Information Bureau (India) Limited, is one of India’s leading credit information companies. It plays a pivotal role in the financial ecosystem by collecting and maintaining records of an individual’s payments related to loans and credit cards. These records are used to create a CIBIL score and report, which lenders use to assess the creditworthiness of applicants.

-

Credit Score:

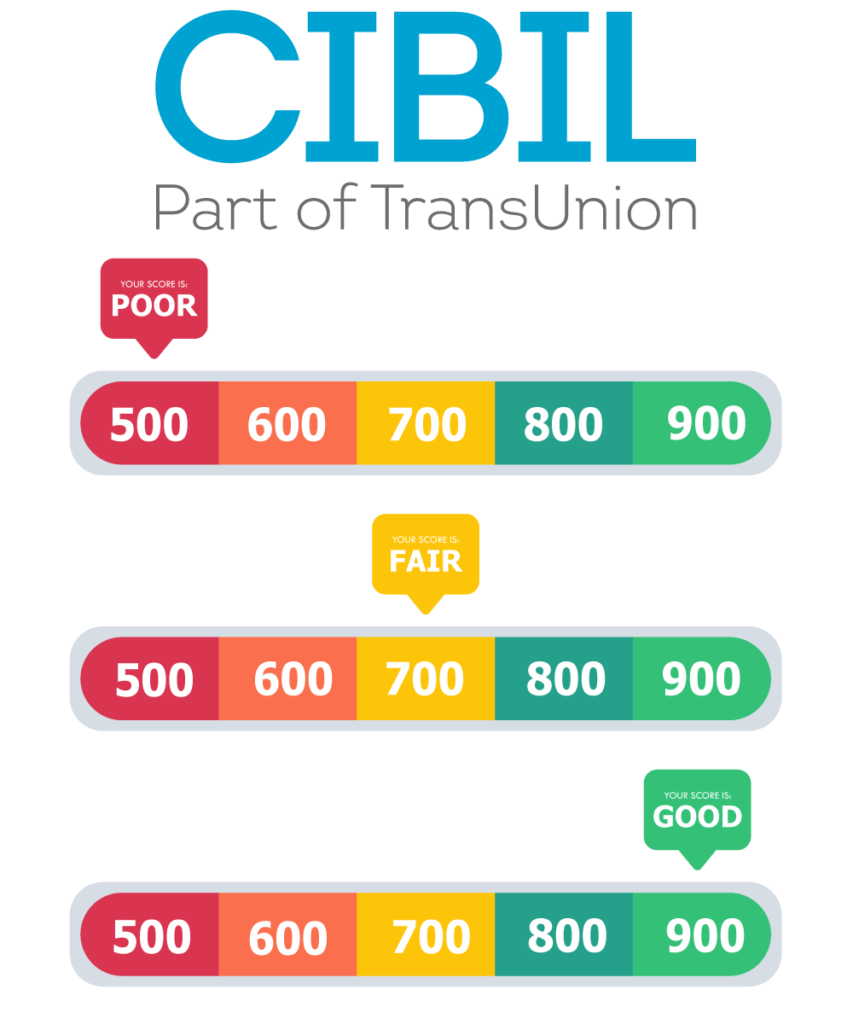

The CIBIL score ranges from 300 to 900. A higher score indicates better creditworthiness, making it easier to get loans and credit at favorable terms.

-

Credit Report

This comprehensive report includes details about your credit history, such as your borrowing habits, repayment history, credit inquiries, and more.

-

Importance

Lenders, including banks and NBFCs, check the CIBIL score and report to decide whether to approve a loan or credit application and to determine the interest rate.

Our Repair Process

We provide tips on building positive credit history and regularly monitor your credit report to track improvements and ensure continuous progress.

Credit Report Analysis

We start by thoroughly reviewing your current credit report to identify negative entries and inaccuracies that may be impacting your score.

Dispute Inaccuracies

If we find any errors, we will assist you in disputing these inaccuracies with the credit bureau to ensure your report is accurate.

Debt Management Plan

We help you create a strategic debt repayment plan aimed at lowering your outstanding debt and improving your credit utilization ratio.

Credit Building and Monitoring

We provide tips on building positive credit history and regularly monitor your credit report to track improvements and ensure continuous progress.

Frequently asked questions

Eligibility criteria vary depending on the type of loan you are applying for. Generally, factors such as income, credit history, age, employment status, and collateral may influence eligibility. Our representatives will guide you through the specific requirements for each loan type.

While the exact documentation may differ based on the type of loan, common documents typically include proof of identity, address proof, income documents (such as salary slips or tax returns), bank statements, and property documents if applicable. Our team will provide you with a comprehensive list to facilitate a smooth application process.

Once you submit your loan application along with the required documents, our team will review your application carefully. The approval process involves assessing various factors such as your creditworthiness, repayment capacity, and the value of collateral (if any). We strive to provide prompt decisions and keep you informed at every step of the process.

Interest rates and repayment terms vary depending on the type of loan, prevailing market conditions, and individual credit profiles. Our goal is to offer competitive interest rates and flexible repayment options tailored to suit your financial circumstances. Our representatives will provide you with detailed information regarding interest rates, EMI calculations, and repayment schedules.

Transparency is paramount at Credit Cares, and we believe in providing clear and upfront information regarding all associated charges and fees. While there may be certain processing fees, documentation charges, or prepayment penalties, we ensure that these are communicated to you in advance to avoid any surprises. Our aim is to maintain complete transparency throughout the loan process and address any queries or concerns you may have.